-

Who We Serve

Overview

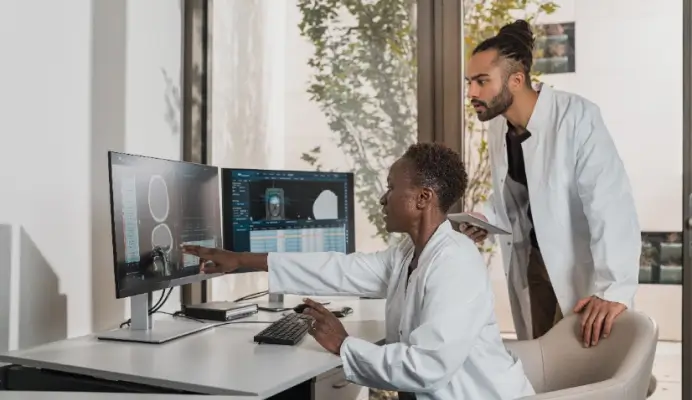

Our technology spans the patient journey to streamline processes and connect physicians, no matter where they are.

-

Product Suites

Overview

Product Suites

Featured Products

-

Resources

-

About

- Book a Demo